Why offering discounts should be a last resort

In 1989, I started my career at UPS. The 17 years I spent there were eye-opening in countless ways, but maybe the most astounding was that up to that point—in its 102-year history—the company had not offered discounts to any customers. Not even the largest ones. Imagine spending tens of millions of dollars annually and paying the same price for a shipment as someone who walked into the retail counter every five years at Christmas!

The odds are good that your business does not have that kind of pricing power. Not even UPS does anymore. They offer incentives to a majority of their customers today because the marketplace is very different than it was almost 30 years ago. Every company must respond to changes in their market, and most will find themselves needing to adjust their prices to stay competitive.

But discounting is rife with peril. It should strike fear deep into the hearts of leaders in an organization. When UPS started offering 1.5 and 2 percent discounts to the largest shippers in the country we heard anxious statements from senior leaders about how the sales team was going to go out and “give away the farm.” Some grumbled about selling their company stock or retiring because the glory days of profitability were clearly over. The company was going down.

As Mark Twain has said, rumors of the death of UPS profits were greatly exaggerated. The company is still alive and well, and competing in a very challenging market while making money. So it can be done, even if you must discount.

Look before you leap

But before you relax I think you should consider some things very carefully. Because you probably still don’t have the pricing power of UPS or Apple or your favorite local cable provider. What impact does discounting have on your company?

Let’s start with profit margin. I’m surprised by how often I ask business owners or sales leaders about their profit margins and they don’t know what they are. While profit is not the only measure of a successful business, and there are other considerations, it is an area where the negotiation skills of your team can have a big impact.

There are multiple ways to calculate margin, and many confusing terms surrounding it. For some basic information, take a look at Investopedia’s page. For a simple profit calculator, you can go to the Omni Calculator website.

A slippery slope

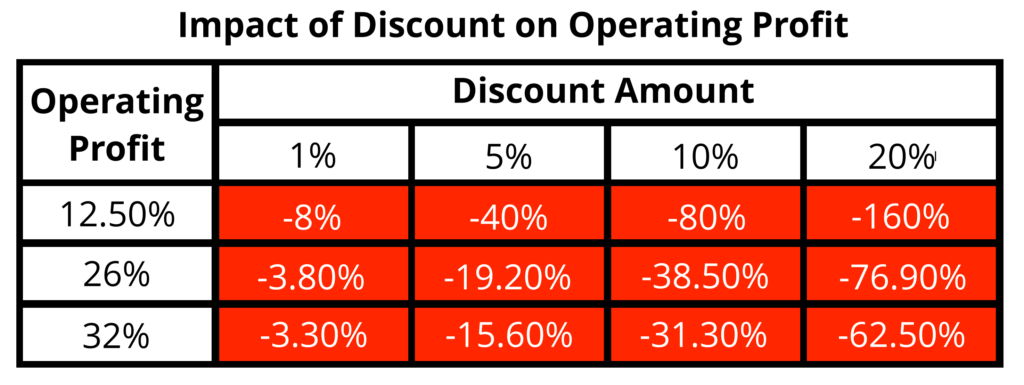

In their analysis of Fortune 1500 companies, McKinsey & Company showed that a price decrease of only 1% brought down operating profit by 8% for a typical company. And lest you think your company is immune because you’re not in the Fortune 1500, here some sobering statistics that might apply to you:

The far-left column shows some typical operating profit margins. The columns on the right start with a discount that would be very rare, but is used to illustrate the outsized impact of any discounting. (Maybe that’s why those UPS leaders were so nervous back in 1989.)

The areas in red indicate the amount your profits are decreased if you or your sales team offer even the tiniest discounts, and the huge impact on profit of typical discounts given in increments of 5%.

MAP Negotiation has developed a calculator to determine the impact of pricing for your specific operating profit. To learn more, contact us here.

But Wait, There’s More…

Most of the time companies make the decision to offer a discount based on competitive pressure (or at least what they believe about it). Buyers convince you that your product or service is a commodity. A competitor offers something that looks similar for less. Salespeople insist that they will lose deals if the prices aren’t reduced, and management responds with permission to offer incentives. You don’t have a choice, right?

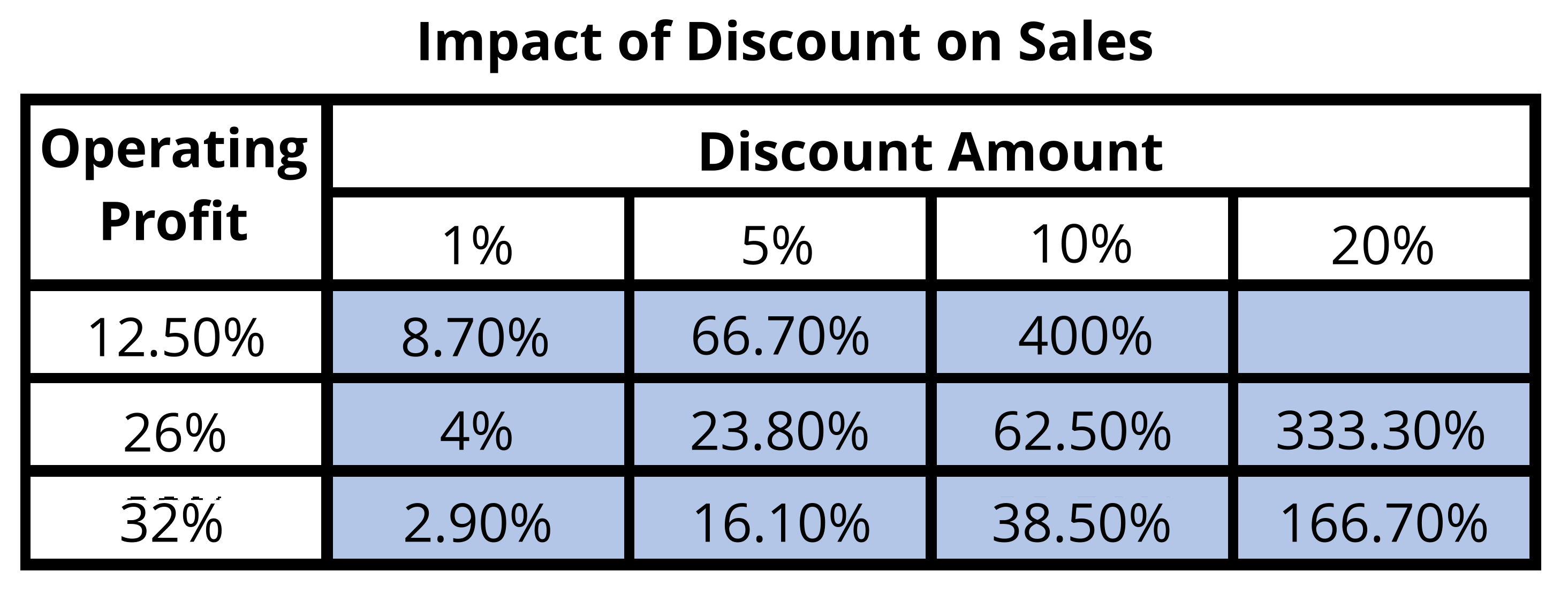

Again, before deciding to reduce your price, consider how much more of that same product or service you would have to sell in order to keep your real profit dollars at the same level. Here’s the same table as above with a different factor applied:

The blue shaded areas show the amount that you must increase your sales to make up for the reduction in operating profit. Talk about putting pressure on your sales team!

To put it another way, if last quarter you sold 3000 items at $200 each with a 26% profit margin, you would make $156,000. If you offered a 10% discount in response to a competitor’s offering, you would have to sell 4875 items next quarter to make the same amount of money. That’s a 62.5% sales increase!

What else can you do?

Competitive pressures are real. More sophisticated, more powerful buyers are convincing your sales team that they must match or beat discounts. Products and services are easier to reverse engineer and duplicate.

The selling and negotiating skills of company leaders and sales team members must be better than ever. Everyone in your organization must learn to communicate the value of your products and services more effectively. And some old habits will have to be changed.

If it’s not broken, break it

For example, the habit of discounting in increments of 5% should be immediately broken. Rather than increase your incentive from 5% to 10%, why not consider 8%? Or even 7.4%. This very small difference can have a big impact. Reducing your price by 2.6% less decreases your profit margin by 10% less. We’ll take a deeper look at this topic in a future blog post, so stay tuned.

In the mean-time, how’s your “farm” doing? What pressures are you facing to give it away?